The current COVID-19 pandemic has exposed the reliance by the U.S. on Asian supply chains for much-needed Personal Protective Equipment essential to deal with the situation. Of primary importance is the supply of medical/surgical facemasks and gowns for healthcare workers. INDA, Association of the Nonwoven Fabrics Industry, is currently assisting many government groups trying to address this issue.* The following article is intended to outline what would be needed for the U.S. to become self-sufficient in the key material area impacting facemasks so we do not encounter shortages in times of critical need.

Nonwovens are engineered materials utilized in scores of applications serving a broad range of sectors, including baby diapers and incontinence products, feminine care products, protective apparel, automotive interiors, consumer and industrial wipes, filtration media, home furnishings, construction materials and medical/healthcare products.

The supply chain challenge

Prior to 2020 (i.e., pre-COVID-19), over 80% of the U.S. demand for medical and surgical face masks (N95 Respirators, N95 Masks, ASTM Level 1,2,3 Masks) was supplied by China and Taiwan. When the COVID-19 situation took hold, both entities withdrew exports of these items to supply their own national demands. The U.S. was left scrambling for these materials for healthcare workers just as healthcare workers were getting inundated with infected patients.

INDA has worked diligently to surface supplies of the much-needed nonwoven material needed to deliver the filtration performance of these medical/surgical masks and respirators. That material is known as meltblown, a polypropylene mat of fine fibers of fixed diameter, pore size and pore density, electrostatically charged to capture the fine particles of bacteria and viruses. We have successfully pulled into the supply chain incremental tonnage from mothballed machines, pilot lines, and manufacturers producing Meltblown for other industries. But it is not enough.

For the U.S. to become self-sufficient in this area, new investment is needed in meltblown manufacturing and that will not be done by the private sector without incentives and without alleviating the risk of China and Taiwan restoring their position as the dominant suppliers of U.S. demand for medical and surgical face masks.

What is needed to provide confidence to these willing participants is some incentive to make the investment now (grants, partial funding, etc.) and a long-term view of sustained demand to enable the investment to earn-out. Most investments in the nonwovens industry need a three-year payback to be approved.

The market for monolithic meltblown (as opposed to meltblown in a composite with spunbond nonwoven, as is used in surgical gowns) is a very specialized and small part of overall nonwoven production in North America. The estimated 2019 U.S. capacity of meltblown is 250,000 tonnes (metric tons). This represents just 4.8% of the 5.2 million tonnes of overall North American nonwoven capacity.

In North America, there are an estimated 75 monolithic meltblown lines in a market with more than 850 nonwoven lines. Of the estimated 2019 meltblown production, 34% was directed towards filtration media (including facemask media and other filtration media), 20% to wipes, 16% to absorbent hygiene, 13% transportation, 8% sorbents, 5% medical/surgical, and 4% apparel. It is estimated that of the monolithic meltblown capacity, prior to the crisis, 78% was used internally by the producing companies (i.e., vertically integrated).

There are 17 companies that have monolithic meltblown lines. Not all of these companies are capable of making meltblown to medical/surgical facemask media specifications, nor are some of the lines configured to be able to sell to the market, as vertically integrated meltblown lines feed the next process, not put fabric in roll form for shipment. Some of the sorbent meltblown producers that use the material internally have or are working on being able to produce facemask media for the market and smaller pilot lines are or will be providing meltblown to the market.

Additionally, within the 1.48 million tonne spunlaid (melted resin) market are spunbond-meltblown composite lines that include meltblown beams. This spunmelt capacity was estimated at 482,000 tonnes in 2019. There are approximately 50 multi-beam lines with meltblown beams in North America. Some of these producers have the capability to produce just meltblown, and at least one is, but the economics of running meltblown only on an SMS line are very poor. A handful of the lines have multiple meltblown beams. There are eight companies with these types of lines in the U.S. and two (3M and Halyard Health) consume all of their material internally for either facemask media or protective medical apparel.

Technologies needed for self-sufficiency

Here is a quick summary of the products in need of U.S. self-sufficiency to deal with the next pandemic:

Respirator Masks, also called the NIOSH N95 Facemask or Respirator, are evaluated, tested, and approved by NIOSH. Surgical N95 facemask/respirators are class II devices regulated by the FDA, under 21 CFR 878.4040, and CDC NIOSH under 42 CFR Part 84. They reduce the wearer’s exposure to particles including vapor, small particle aerosols and large droplets. They are typically molded in a cup shape to follow the contour of the face and are tight fitting with an exhale valve. They require fit testing and a user seal check each time the mask is donned. When properly fitted and donned, minimal leakage occurs around edges of the mask/respirator when the user inhales, thus protecting the wearer. Ideally, they should be discarded after each patient encounter. This is primarily the domain of 3M, with an estimated market share of 80%. 3M is vertically integrated in the U.S. producing nonwovens and converting. Owens & Minor’s Halyard Health (vertical integrated, nonwovens produced in U.S. and converted in Mexico and/or Honduras), Kimberly-Clark Professional (assume vertically integrated and converted in U.S.), and Prestige Ameritech (converter) also produce these types of masks.

Surgical Masks, also called N95 Medical/Surgical Face Masks, are cleared for healthcare use in the U.S. by the Food and Drug Administration. In order to be called a medical/surgical mask, a minimum 95% filtration rate is required. They are fluid resistant and provide the wearer protection against large droplets, splashes, or sprays of bodily or other hazardous fluids. The also protect the patient from the wearer’s respiratory emissions. They do not provide the wearer with a reliable level of protection from inhaling smaller airborne particles and is not considered respiratory protection. Leakage occurs around the edge of mask when user inhales. They are measured by three levels of ASTM barrier protection. ASTM specifies the performance requirements with five basic criteria: Bacterial Filtration Efficiency, Particulate Filtration Efficiency, Fluid Resistance, Delta P (Pressure Differential), and Flame Spread. The lowest level, Level 1, has both a Bacterial Filtration Efficiency and Particulate Filtration Efficiency of ≥ 95%., hence the designation of 95. In addition, all medical face masks must be tested to an international standard (ISO 10993-5, 10) for skin sensitivity and cytotoxic tests to ensure that no materials are harmful to the wearer. They are also designed for sterile environments and should be discarded after each patient encounter.

Necessary next steps

The major U.S. producers are 3M, Cardinal Health (typically U.S sourced nonwovens converted by Cardinal in Mexico), Halyard Health, Kimberly-Clark Professional, Prestige Ameritech and Gersten. There are several announcements of companies now getting into facemask production, but they cannot make the medical/surgical facemasks without the meltblown media, and they are not able to source this product at this time.

To increase the U.S. production of the much-needed meltblown fabric, new investment is needed in the production machinery. INDA has identified eight companies operating in the U.S. who are interested in investing in monolithic meltblown production under the right conditions of incentives and sustainable demand. Five of these companies are U.S.-owned; three are U.S. companies with foreign ownership. All have the nonwoven operating experience and meltblown technology expertise to get a new machine up and running. All are concerned that once this crisis is over, the supply chain will revert to Asia based on price.

What is needed to provide confidence to these willing participants is some incentive to make the investment now (grants, partial funding, etc.) and a long-term view of sustained demand to enable the investment to earn-out. Most investments in the nonwovens industry need a three-year payback to be approved.

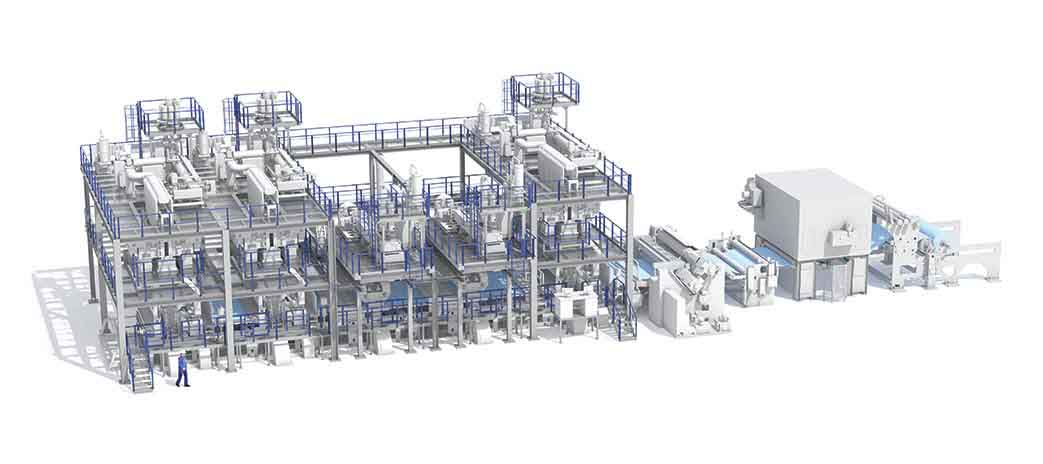

As a ballpark gauge of investment and output, we approached Reifenhäuser Reicofil, the noted German manufacturer of nonwoven equipment. They are quoting 3.5-month delivery on the following:

- Single Beam 1.6m MB Line: $4.15M, another $1 million to install/start, will make meltblown for 600 million medical/surgical facemasks.

- Single Beam 3.2m MB line: $6.2M, another $2 million to install/start will make meltblown for 1.2 billion medical/surgical facemasks.

As policy makers evaluate how to be prepared for the next pandemic, using federal funding to spur such investment, and implementing a supportive approach to a National Stockpile for medical/surgical facemasks to ensure demand, would be a meaningful step toward assuring supply of a critical product. INDA stands ready to assist initiatives in this direction.

* Data highlighted in this article is based on research produced by INDA, Association of the Nonwoven Fabrics Industry. International Fiber Journal is owned by INDA.