World fiber supply was balanced between natural and manmade fibers a quarter of a century ago but the latter considerably gained momentum afterwards, holding a current market share of more than 70% in recent years. Consequentially, corresponding feedstocks have been expanded likewise. Massive investments in Chinese industry will increasingly impact today’s major supplying nations. Nylon 6,6 precursor capacity additions in China may disarrange future trade flows. This article refers to investments for polyester, nylon and viscose raw materials. Covid-19 may have postponed construction or final decision of some projects, which will be described in detail in The Fiber Year 2021.

Polyester is the leading fiber material with a 55% share in the global business, benefiting in particular from low crude oil prices. The price pressure even further increased after approaching century’s low in April 2020 as result of the price war Saudi Arabia initiated with Russia. Demand for crude, collapsing amid the coronavirus pandemic like never seen before, prevented prices to recover despite the deepest oil production cuts during the global lockdown measures.

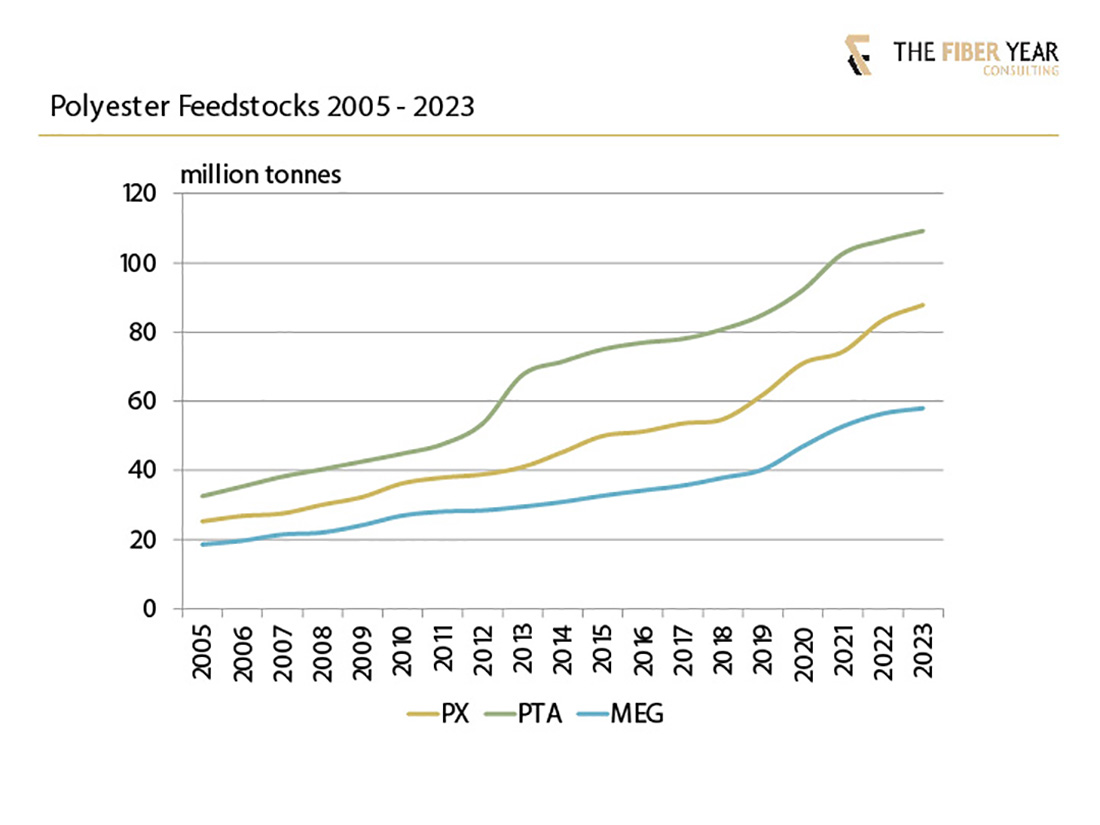

The main polyester feedstocks are paraxylene (PX), purified therephthalic acid (PTA), which has almost entirely replaced dimethyl terephthalate (DMT), and mono ethylene glycol (MEG). The past development, including an outlook until 2023, is illustrated in Figure 1.

A total of 13 million tonnes PX nameplate capacity started up in 2019; six lines were put into operation at global stage, five lines in China and one line in Brunei. Thus, annualized capacity growth accounted for 13% to 62 million tonnes at the end of 2019. Fuhaichuang Petrochemical, formerly Dragon Aromatics in Zhangzhou, Fujian province, has restarted its second 800,000-tonne line in early 2019; the line was shut after a massive fire in April 2015. It is quite obvious that these massive investments with another 13 million tonnes in the pipeline for the Chinese market until 2023 will cause severe over-supply and the spread between PX and upstream naphtha has already come under pressure from mid-2019; in addition, industries in Japan and Korea that jointly meet more than half of Chinese PX imports will suffer.

The annualized PTA capacity growth amounted to 5%, reaching a level of 85 million tonnes in 2019 after three start-ups in China. No PTA addition outside China in 2020 will come on-stream after postponement of a start-up in India. Additional projects further down the line target Oman, Russia, Saudi Arabia, Turkey and U.S.

Previous year’s MEG capacity expansions experienced a similar growth rate of 6% like in the year before, lifting world capacity to around 40 million tonnes. Initially, accelerated growth for 2019 was expected but did not realize due to delays of Chinese coal-based MEG projects. In total, 10 new production sites came on-stream with seven units located in China and three facilities in the U.S.

Raw material investments for nylon 6 experienced an annualized capacity growth of 5% to almost 8 million tonnes in 2019 with three new lines being put into service in China and debottlenecking projects in U.S. and China. Chinese investments were further supported by anti-dumping duties on caprolactam imports from EU and U.S., imposed in 2011 and extended for five years in October 2017. Caprolactam investments have been pushed by the prolongation of Chinese anti-dumping duties and retrieval of shares from nylon 6,6 due to an anticipated raw material shortage in adiponitrile (ADN). However, strong ADN expansions in China and U.S. are on the radar to lift global capacity by more than 50% until 2024 following a recent expansion in France at the end of 2019.

The manmade cellulosic fiber segment continued its breathtaking recovery that began in 2002, marking again a new all-time high last year beyond 7 million tonnes. The staple fiber business in particular has outperformed the entire market of synthetic staple fibers in every year since the financial crisis, thus recording higher dynamics for the 11th consecutive year. In fact, dynamic viscose fibers growth of almost 8% to arrive at 6 million tonnes was the fastest among mainstream manmade staple fibers.

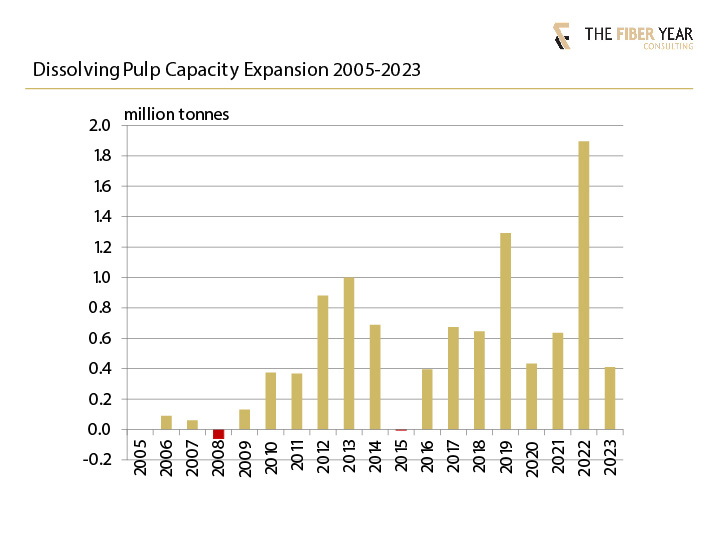

The brisk viscose fiber demand explains rising upstream dissolving wood pulp investments that are predicted to witness an unprecedented size of new capacity around the globe in 2022. Actual capacity more than doubled within a decade, which is an unprecedented size of expansion.

Debottlenecking, shifting toward specialty grade, enhancing capacity at swing mills, expansions and conversion of existing plants, start-up of new lines and a mill closure occurred last year. The nameplate capacity was lifted around the world by nearly 15% to about 10 million tonnes. Annualized capacity growth in the Americas, the area with the largest installations until 2017, amounted to 1%, Europe up by 9% and Africa lifted capacity by 4%. Asian capacity surged by a third, which was the fourth consecutive expansion at double-digit growth rate.

The next installment of “The Fiber Year” column will summarize latest trends in the global staple fiber industry.