The 20th anniversary issue of The Fiber Year includes textile and clothing trade data for 60 countries, of which most in 2019 were on a lower level. Some Asian low-cost industries succeeded to lift exports, with Cambodia and Myanmar recording double-digit growth rates. The fastest increase of exports in relative terms has been noticed for Brazil to mark a new all-time high. Joint trade surplus of PR China and India declined 2% to $275 billion, while the joint trade deficit of the United States and 28-nation European Union lessened 1% to $162 billion. The global economic crisis triggered by the outbreak of COVID-19 led to dramatic trade losses in the first half 2020, as illustrated by means of selected nations.

The majority of the top-10 exporting countries suffered from declining shipments in value terms in 2019 (Figure 1). Joint export value declined 1% to $549 billion.

The recovery of Chinese exports from 2017 and 2018 came to a temporary halt in particular due to the U.S.-China trade war, losing about $4 billion export value, despite a weaker currency. Total exports softened 2% to $272 billion with textile exports marginally rising 1% to $120 billion. Apparel shipments fell 4% to $151 billion, down $35 billion from peak in 2014.

Germany in second position may surprise and can be explained, just as for the other EU members, with predominant intra-regional border crossing activities. Italy has the highest non-EU export share at 46% and Czech Republic the lowest at 10%. Thus, taking into account extra-regional EU exports only, last year’s performance of the area was tolerably unchanged at $59 billion.

Vietnam, India and Bangladesh were prominent beneficiaries from intensifying trade tensions between the United States and PR China, lifting their imports into the U.S. between 5% and 12%. Smaller importing nations into the U.S., like Cambodia (+20%), Honduras (+10%) and Myanmar (+72%), were also able to take advantage.

Vietnam’s garment and textile exports achieved a robust 6% rate of expansion to $38 billion, thanks to strong increases in all main markets and the EU-Vietnam Free Trade Agreement, that is expected to enter into force during the summer of 2020. It will offer additional opportunities.

India’s exports decreased 3% to $36 billion despite expanded shipments of knitwear (+4%) and woven apparel products (+6%) to mark a seven-year low in trade surplus.

The paramount importance of the textile chain in Bangladesh becomes obvious as its share in national exports remained one of the highest in the world, although slightly easing from 91% in 2015 to 87% in 2019. Minor export growth to $36 billion resulted in a new trade surplus peak after continuous 12-year growth.

Brazil, a smaller exporter at below $4 billion, succeeded to push shipments by 38% to mark an all-time high following record high cotton shipments, as a consequence of bumper cotton crop with the trade deficit falling to the lowest value in 10 years.

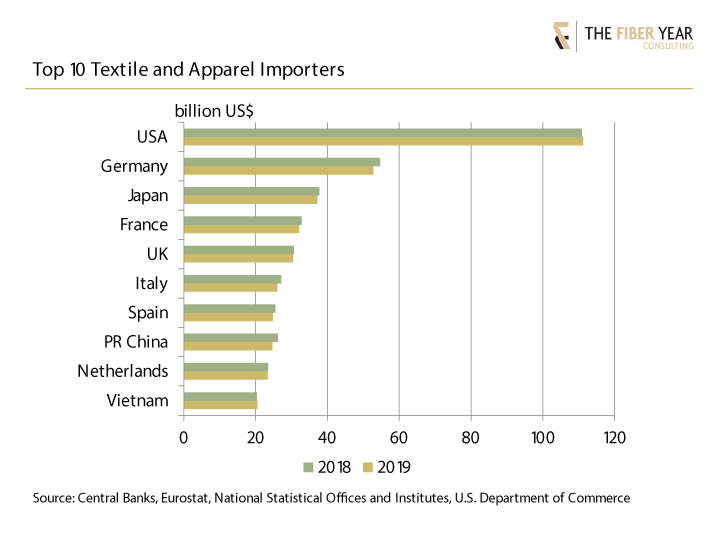

Slowing imports were mostly visible across the globe (Figure 2). U.S. imports decelerated but, nevertheless, reached the second-highest value in history at $111 billion. Shrinking Chinese deliveries to $36 billion meant its market share further weakening from its peak of 41% in 2010 to below 33% in 2019. Vietnam‘s share of the U.S. market further gained weight to 13% after expanding 12% to $14 billion. Vietnam’s imports recorded an unusual flat movement with 15% lower cotton value, whereas the fabrics import value continued to grow by 5%, reflecting the industry’s heavy dependence on purchasing fabrics abroad.

All selected economies with six-month textile and clothing export data suffered from steep double-digit contractions (Figure 3). The joint shortfall of the twelve listed industries accounted for around $37 billion.

Chinese data include clothing exports only as an obvious re-classification of facemasks that conveniently puts the textile category into positive growth despite heavy losses in exports of textile raw materials, yarns and fabrics. Apparel shipments with above-average contraction of knitwear exports fell by about $15 billion to $51 billion in the first half of 2020, gradually weakening from record high exports of $186 billion in 2014. In fact, they have been suffering from 16 monthly decreases in the last 20 months already.

Bangladesh and Vietnam suffered from a fierce 29% contraction of textile and clothing exports. This slump poses a severe challenge to the economy in Bangladesh as the textile chain is of paramount importance to generate foreign exchange with its share in national exports being one of the highest in the world at nearly 90%. In contrast, Vietnamese export structure is more diversified with textile and apparel accounting for about 15%.

Turkey benefited from strong gains in the first two months after coronavirus outbreak in Asia as European apparel orders moved to Turkey with essentially woven garment exports soaring 9%. Total shipments fell between 23% and 61% each on monthly basis from March to May after Europe became the new epicenter of coronavirus infections. Performance in the first six months was 20% lower at $11 billion, which corresponds with a share in national exports, similar to Vietnam, of 15%.

The slump in U.S. exports comprises a sharp 30% decrease in apparel products, indicating considerably lower expenditures for garments as mass work-from-home policies had people more focused on refurbishing their homes, which resulted in strong gains of home textiles, furnishings and carpets. In addition, shipments of yarns fell 30% and fabrics by 20% due to often extended lockdown measures in the region.

A positive export performance in the first six months of 2020 was a rare exception. Brazil succeeded to lift shipments by 26% thanks to surging dynamics in the first quarter. The country already marked all-time high exports in 2019 following record high cotton shipments. Bumper cotton crop in 2019/20 season allows to further expand cotton exports to a peak level despite COVID-19, dampened expectation for commodity consumption and the impact from the U.S.-China Phase One trade deal.

The next installment of “The Fiber Year” column will summarize current and planned investments of major manmade fiber feedstocks. For more information about The Fiber Year report, visit thefiberyear.com.