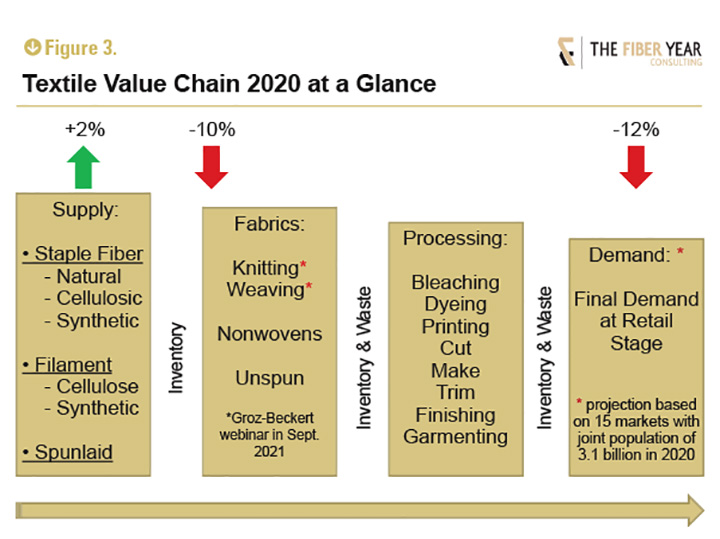

World fiber supply was razor-thin in the red, subsequent fabric processing sharply plummeted and the projection of final demand at the retail stage based on 15 markets with a total population of 3.1 billion was even a little stronger below previous year. Diverging dynamics along the value chain came as a surprise because manmade fibers quickly can be controlled to match demand. Thus, a holistic approach is increasingly gaining weight.

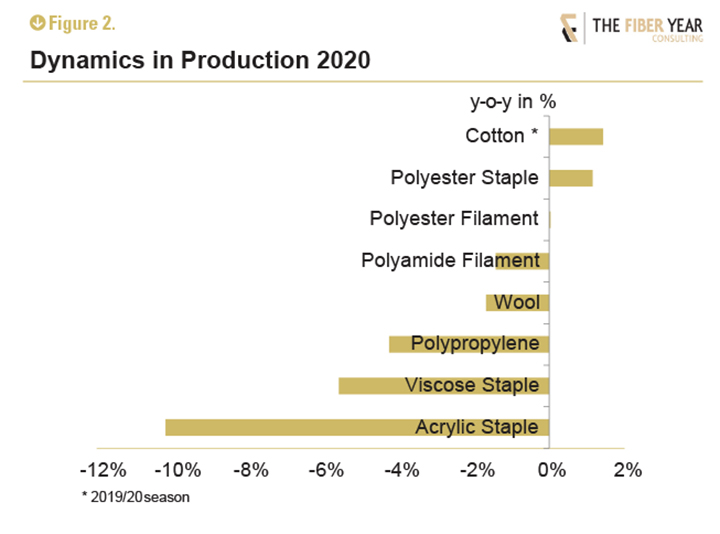

Fiber and yarn supply was projected 10% down and finally came in tolerably stable after unexpected strong official output data from Beijing, indicating a speculative rebound from mid-2020 with substantial inventory accumulation. World fiber supply experienced a modest recovery in natural fibers, with cotton projected to drop in the current season. Manmade fibers recorded an almost unchanged volume of synthetics despite the first decline in filaments since the financial crisis of the late 2000s, while wood-based cellulosics suffered from contraction of both filament and staple fiber. In total, the manmade fiber business saw surprisingly robust production in PR China, while all other industries across the globe jointly contracted at a double-digit rate.

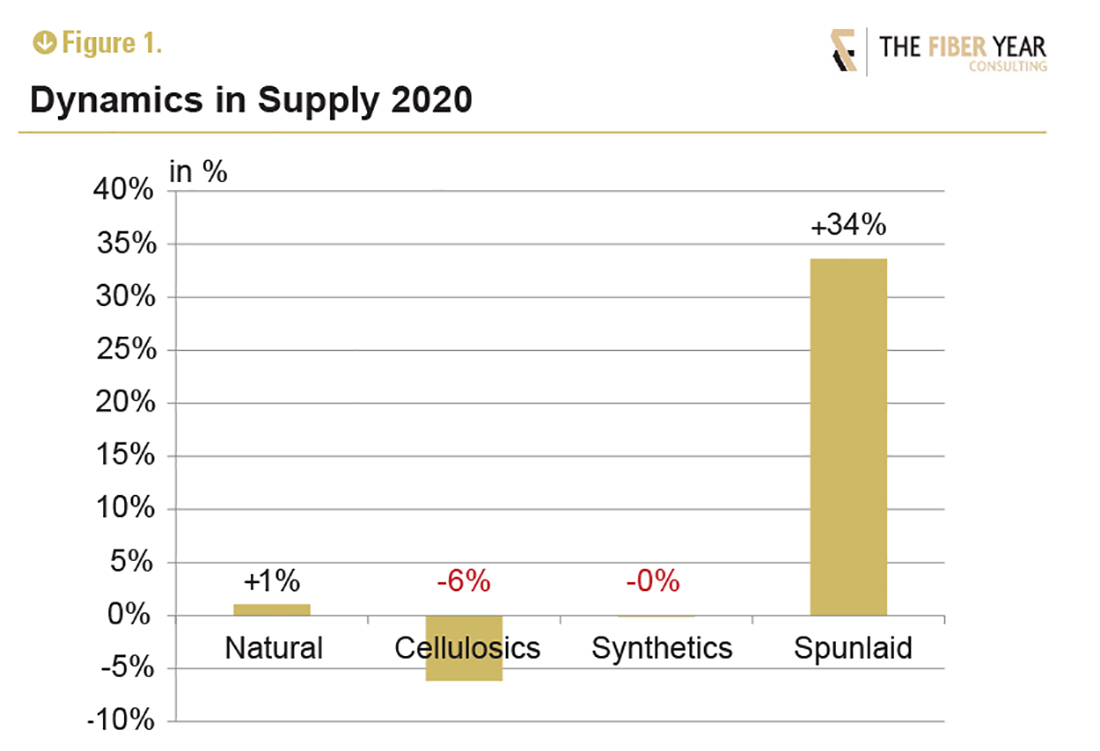

The scope of global supply in 2020 was enlarged by polymer-based nonwovens. Spunlaids enjoyed the most dynamic development in the century, with an average annual growth rate of 9.5% to exceed 9 million tonnes last year. Surging demand in disposable products for cleaning and disinfecting wipes, medical fabrics, filtration and facemasks lifted global nonwovens demand at unprecedented speed following massive investments across the globe and strong gains of Chinese textile article exports due to facemask shipments increasing almost tenfold.

A closer look into mainstream fiber types reveals the fastest dynamics for cotton output, as the decision for planting was already made ahead of the pandemic. Polyester was the only manmade staple fiber, apart from small-scale nylon, with growth in 2020, even if stronger growth was initially projected. However, Chinese expansion was comparatively slow according to China Chemical Fibers Association due to lower recycled fiber volumes following virgin material price spread further narrowing. Both segments benefited from an increasing preference of retailers and brands for standard blends such as CO/PES at lower prices, as consumers cut spending for necessary pieces of garment given losses in disposable income and uncertainty about future economic outlook and job security.

Stagnation in polyester filament, hitting 12-year low in rate of growth, was primarily caused by the slow movement of textile and industrial yarns, while carpet yarns witnessed excess demand and supply even could have been higher if more resin would have been available. Consumption levels benefited from a surging number of home improvement projects, as people spent more time at home and less money on vacation.

In addition to the demand shortfall causing most fiber types to enter negative growth territory, the synthetic fiber industry was affected by an alarming surge of force majeure declarations and technical issues that continued into 2021, causing temporary shutdown of spinning lines across all synthetic fibers.

Key figures along the textile value chain illustrate diverging dynamics from supply to demand at retail stage. Supply of natural fibers marginally rose, manmade fibers and filaments inched down, while surging spunlaid production overcompensated for the drop at fiber side and brought global supply into positive growth territory.

Calculations of the processed volume at fabric stage revealed significant losses in knitting, drastic contractions of weaving operations, while fiber-based nonwovens recorded robust growth that ultimately did not succeed to reach its century’s average growth dynamics.

Thanks to the long-term cooperation with Groz-Beckert, a leading provider of industrial machine needles and precision parts for fabrics production, The Fiber Year has access to national fabric volumes, as presented in a virtual webinar “The Fabric Year 2020” (available on YouTube). This webinar format will be revisited with “The Fabric Year 2021” presented in September, again with support from Groz-Beckert. To be added to the invitation list for this webinar, email info@thefiberyear.com.

The next installment of “The Fiber Year” column will take a look at textile and apparel trade in 2020, enriched with the latest year-to-date figures.