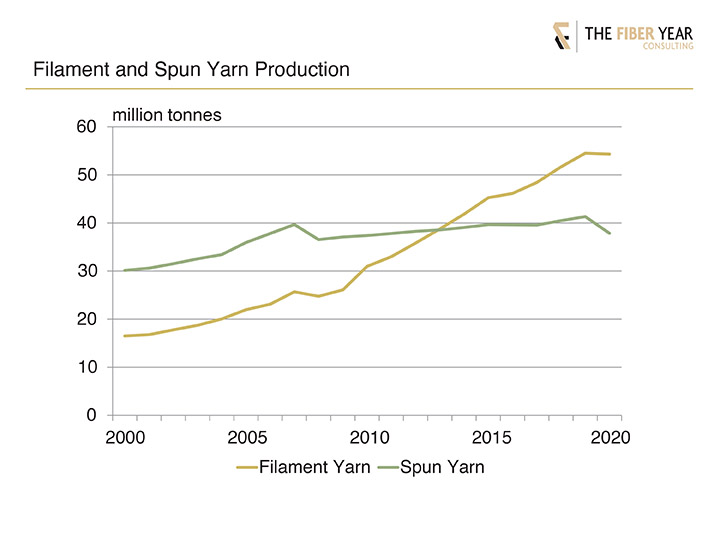

Significant collapse in 2020 demand across the globe has affected global yarn manufacturing that fell 4%, with filaments weathering tough conditions surprisingly well, while spun yarns suffered from an above-average decrease, indicated by around 3 million tonnes downwardly revised cotton use shortly after the WHO declared a pandemic.

The filament industry has typically produced above-average growth rates, amounting to an average annual growth of nearly 6% since 1980, while synthetic and wood-based manmade staple fibers grew at an average rate of 3% annually.

The dominant filament type with a sector share of 85% is polyester, which has been benefiting from advantages in price and its versatile end-uses. Polyester was the obvious beneficiary of pandemic-induced economic uncertainty and slowing of demand at the retail stage following a collapse in consumer spending and modified patterns of consumption, as the manufacturing level was tolerably stagnant. Other mainstream synthetics saw single-digit declines, whereas viscose yarns plummeted by around 18%. In total, world filament yarn manufacturing stagnated at about 54 million tonnes.

In contrast, the spun yarn business suffered from a strong 8% drop to 38 million tonnes, and its relative segment share worsened from 65% at the beginning of the century to about 41% at present. Growth dynamics will continue to be in favor of filaments due to their advantages in price and millions of tonnes primarily expanded polyester filament from large-scale backward integrated Chinese majors, which will exert more pressure on American and European markets after shipping rates and delivery schedules return to normal levels.

However, learning from history is advisable and means recalling the first oil crisis in 1973 that went along with rapidly surging feedstock and energy costs, adverse conditions we are feeling right now as well. This caused a two-year dive in synthetics output.

Figure 1 illustrates development and dynamics of both yarn types. Volumes from primary spinning stage taken into account for spun yarn production include cotton, wool and manmade fibers, but no bast or other natural fibers.

The Fiber Year 2022 report, scheduled for release in May, will provide the latest information on yarn manufacturing during the first full year of the pandemic. It will be exciting to see whether industry will succeed in overcoming pandemic-induced shortcomings as fast as we had seen the former recovery from the financial crisis in the late 2000s.

At that time, a rapid V-shape recovery in both industries evolved into soaring filament production, as the spun yarn sector was badly affected by surging cotton prices between Q4 2010 and Q1 2011, thus stimulating re-orientation in favor of filaments and supply chains rapidly adjusting to new yarn options helped by lower priced filaments.

However, learning from history is advisable and means recalling the first oil crisis in 1973 that went along with rapidly surging feedstock and energy costs, adverse conditions we are feeling right now as well. This caused a two-year dive in synthetics output.

Without addressing further constraints, such as inflationary pressure, squeezed margins at spinning stage, tight raw material markets, logistical issues, staffing shortages, semiconductor shortages, or the current IMF projections from late January suggesting global economic growth is in the middle of a descent – to mention a few – it looks like two lost years for the world fiber industry is more likely than the one-year loss experienced during the financial crisis of 2008/9.

Before the global picture becomes clear, we can look at market forces in the yarn industry. The controlling position of filament yarns has further gained weight, lifting the market share to 59% at present, up from 35% in 2000. This goes along with a more than tripling of the filament quantity in the century.

Short staple yarns saw their share gradually declining from 55% in 2000 to 37% at present, while long staple yarn lost more than half in relevance, down from 10% to 4% share. They have increasingly been suffering from weakness of major fiber materials such as wool, acrylic fibers and long staple cotton witnessing more distinct contraction than short staple cotton in last year‘s use.

The next installment of “The Fiber Year” column will summarize key findings of TFY 2022 report, which is scheduled for release in May.