World supply was pushed by manmade fibers but century’s average annual growth rate was missed in the third consecutive year and adverse conditions prevailing make a return to the long-term growth path rather highly disputable.

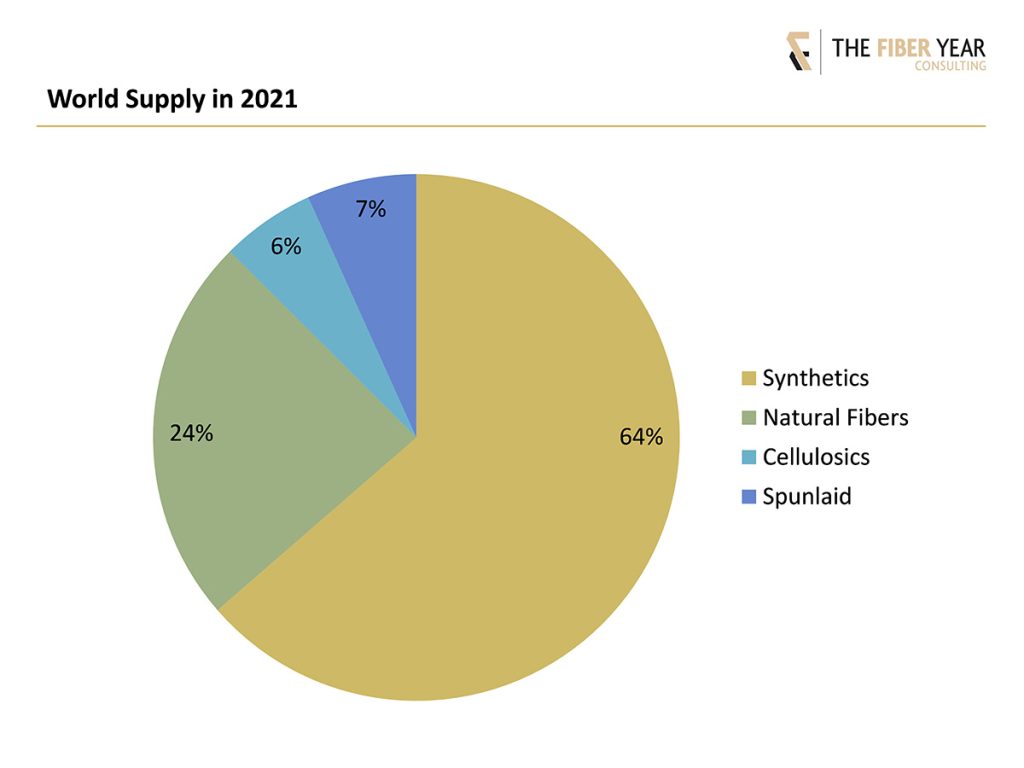

Global supply rose less than 4% to 127 million tonnes, equal to an average 15 kg per capita consumption. The largest segment with 64% share comprised synthetic fibers with both mainstream types polyester and nylon expanding almost 10% each, polypropylene inching up 1% and acrylic fibers contracting in the tenth consecutive year by 2%. Growth was further visible in small-scale segments such as aramid, carbon and spandex fibers.

The second-largest sector with 24% share included natural fibers with last year’s sharp declines in cotton and flax production due to pandemic-induced inventory accumulation in the year before.

Cellulosic fibers, eldest manmade fiber derived from essentially wood, are in the midst of a multi-

decade growth phase and marked a new all-time high, occupying at present 6% share. They experienced gains across the board and the fastest growing fibers were modal and lyocell at distinct double-digit rates each.

Finally, spunlaid nonwovens declined as expected for the first time in three decades. Outsized hygiene demand in 2020 led to 7% decrease and their ratio in world supply accounted for almost 7%. Most global sources refer to the fiber size only, but a market size of spunlaids at more than 1 kg per capita consumption by now should not be neglected.

Performance in 2021 was mostly characterized by positive growth; it certainly was not a broad-based recovery and a return to the long-term growth path appears ambitious in 2022. Geopolitical instability, adverse economic and logistical conditions prevailing make this target highly unlikely. Century’s average annual growth rate amounted to 3.8% with supply underperforming in the third consecutive year, thus, an accumulated volume of almost eight million tonnes was lost. World business will lose another year of growth as a calculated 7% expansion to go back to the long-term growth rate appears out of reach.

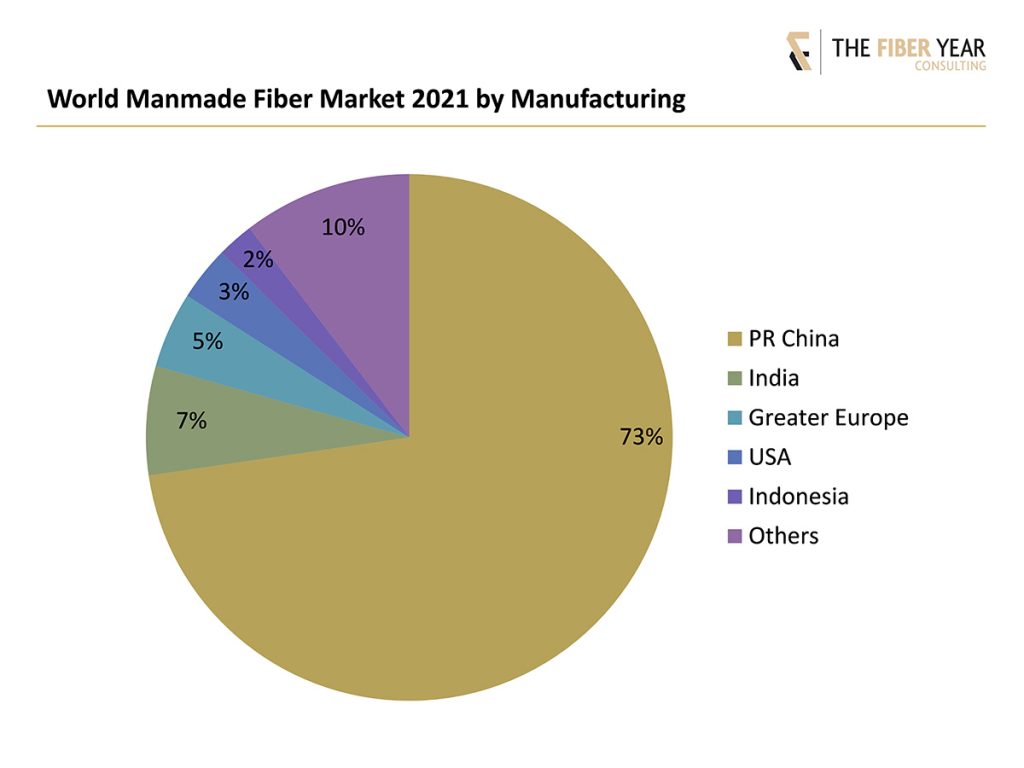

World supply was lifted thanks to 9% expansion of manmade fibers that currently hold an almost 70% share. In regional terms, the top five manmade fiber producing countries with Greater European region including all European states, Turkey and CIS countries amounted to a 90% share.

Chinese industry recorded 8% growth to 64 million tonnes to reach a new all-time high following strong gains in polyester, nylon and spandex while polypropylene modestly rose and acrylic fibers continued their five-year contraction.

A similar growth rate was realized in India to arrive at six million tonnes; still below 2018/19 levels due to the weak polyester business while nylon and wood-based cellulosics hit new peaks each.

Greater Europe experienced 11% rebound to four million tonnes thanks to above-average increases in Turkey while 27-nation EU improved but remained at second-lowest level in the quota-free period.

U.S. industry expanded 8% to three million tonnes even if labor shortage and extended lockdowns in Caribbean region prevented higher operating rates.

Indonesia witnessed 18% boost to two million tonnes, which was rather a technical reaction after a steeper contraction in the year before.

Remaining industries grew by 11% to nine million tonnes. In total, the world beyond China jointly rebounded at faster pace by almost 11% to just return to pre-pandemic level. Improvements, essentially in Europe and U.S., were partly based on high freight costs, port congestions, supply disruptions and not calculable delivery times that hampered production scheduling with sourcing policy in Asia.

For the first time ever, the segment of wood-based cellulosics was subdivided by spinning process in The Fiber Year 2022 report.

Dynamics for essentially wood-based lyocell fibers came to temporary halt in 2020 but bright prospects for future growth quickly returned late 2020 and are projected to remain in place at potentially accelerated pace. This is indicated by global investments, superior fiber properties including biodegradability, growing awareness of plastic waste from oil-based fibers, and of consumers for environmentally-safe clothing, improved security of supply over natural fibers and sheer limitless raw material supply, which became increasingly important given a large number of technical issues and force majeures at synthetic fiber feedstock industries with occasionally tight markets limiting spinning operations.

The entire business saw previous year‘s output recovering 7% to seven million tonnes thanks to manufacturing exceeding pre-pandemic levels in most industries across the globe except for China, Japan and Taiwan. Double-digit growth rates were noticeable for specialty fibers such as lyocell and modal as well as viscose filaments while regular and eco-friendly fibers came close to pre-pandemic level after growing 6% and acetate tow realized growth despite slowing in prime market of cigarette filters but benefiting from expansion in textile end-uses.