The Fabric Year 2022 is a unique service as the result of joining forces between Groz-Beckert and The Fiber Year to combine the upstream spinning industry with fabric making stage including the latest trends and market developments in knitting, weaving and nonwoven. Global supply of fibers and yarns was clearly pushed by manmade fibers while natural fibers declined. Fabric making stage was characterized by recovery of both the traditional technologies and a historic decrease in nonwovens.

Fibers and Yarns

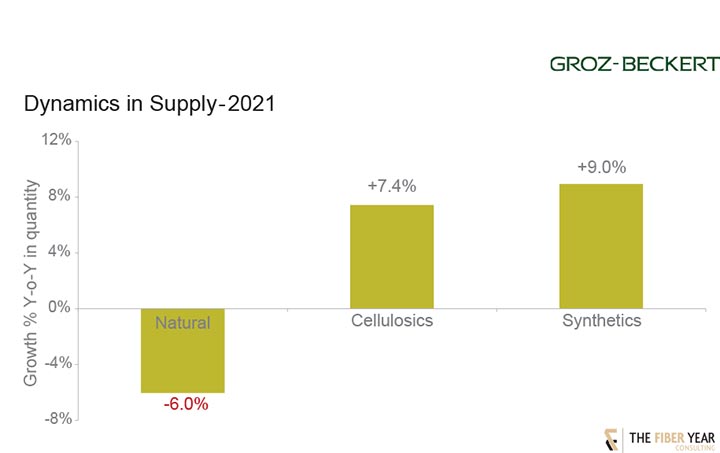

Global supply of fibers and yarns was clearly pushed by manmade fibers. Major drivers were both the mainstream types polyester and nylon, expanding almost 10% each as well as small-scale segments such as aramid, carbon and spandex fibers. Cellulosic fibers marked a new all-time high. They experienced gains across the board with the fastest growing fibers including modal and lyocell at distinct double-digit rates each.

The natural fibers business suffered from the fastest decline in five years due to pandemic-induced inventory accumulation, essentially in cotton and flax.

Supply at the global stage recovered last year to around 119 million tonnes, equal to an average 15 kg per head quantity. However, world upstream industry has lost a joint volume of nearly 9 million tonnes in the previous two years when calculating with the century’s average annual growth rate until pandemic outbreak.

The performance in 2021 was mostly characterized by positive growth but it certainly was not a broadly based recovery. In fact, a number of adverse economic conditions and logistical prevented a return to the long-term growth path and it also appears ambitious or rather highly disputable for 2022 and the year after.

An overwhelming share of 60% fiber material originates from mainland China that witnessed modest growth in natural fibers, primarily cotton, and strong gains in polyester, nylon and spandex to reach a new all-time high.

India, in second position and the world’s largest supplier of natural fibers, continued its transition from cotton to manmade fibers. The Indian textile industry worth about US$150 billion at present is projected to expand above US$350 billion within the next five years. To reach this target, manmade fiber demand is likely to see a big boost as cotton production has reached a plateau at around 6 million tonnes annually and is not expected to increase significantly. Thus, the industry needs an incremental manmade fiber production of 10 million tonnes with both nylon and wood-based cellulosics hitting new peaks last year already and cotton cultivation slightly declining.

Cellulosic fibers marked a new all-time high. They experienced gains across the board with the fastest growing fibers including modal and lyocell at distinct double-digit rates each.

United States, Türkiye and European Union all experienced double-digit losses in cotton harvesting but succeeded to lift manmade fiber production. U.S. manufacturing returned to pre-pandemic level, Türkiye marked a new peak following further polyester capacity build-up and commissioning of the country’s first lyocell line while European recovery was much slower due to the closure of acrylic and spandex fiber lines.

Knitted Fabric

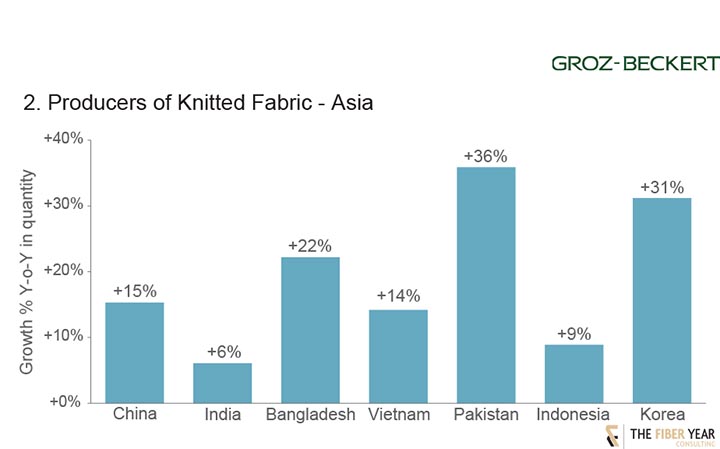

2021 was a good year comparatively with the first stirrings of recovery already visible by the end of 2020, when the orders for new knitting machines increased. This trend continued in 2021 with lots of new weft and warp knitting machines entering the market. The production of knitted fabrics in all of the big markets recovered compared to 2020 although the knitting industry was still facing a lot of obstacles in 2021, like increased prices for raw materials including yarns.

The biggest textile hub, China, struggled through the year due to its zero-COVID policy. Several strict lockdowns and factory closures continued in 2021 which had a severe impact on knitters and machine builders. China’s policy of “dual control” of energy consumption, which targets to reduce the total energy consumption and the energy intensity, also had an impact on the textile production in some areas.

The orders continued to move from China to other Asian countries including Vietnam, Bangladesh, and India due to delivery reliability and overall cost factors. The fabric output from these countries showed good recovery especially the knitted fabric continued to be in higher demand.

Vietnam, which maintained a quite stable fabric output in 2020, suffered more in 2021, especially between July and September, when local lockdowns stopped the fabric production in a lot of areas. But due to a good start and a quick recovery at the end of the year, Vietnam managed to increase the output of knitted fabrics by around 14% compared to 2020.

Bangladesh also faced some heavy lockdowns in April and the beginning of May. But after the reopening in May a lot of the knitting mills immediately had full orders booked for the next few months. Bangladesh also benefited from the lockdowns in other countries, so the orders were shifted to Bangladesh.

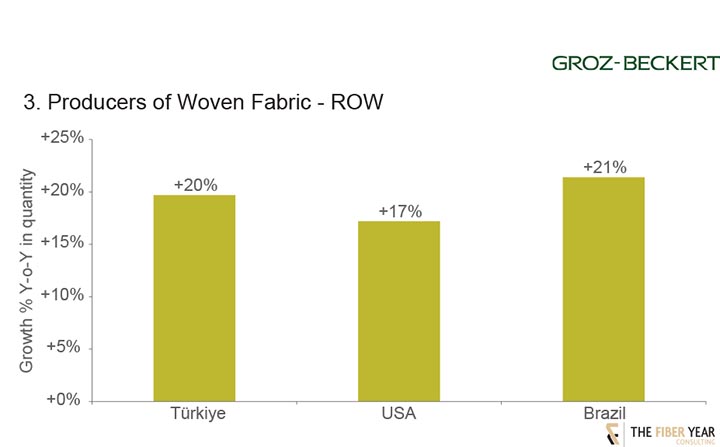

Besides Asia, we also saw a good recovery in the European and American markets like Türkiye and the United States. Unlike 2020, there was no bigger lockdown in Türkiye in 2021. Like other countries, Türkiye faced a huge increase in prices for raw materials like yarn. On top of this price increase Türkiye also struggled with a high inflation rate. Due to the depreciation of the local currency, textile exports from Türkiye got cheaper and therefore more attractive. This can be seen in the export data of knitted fabric and of knitted apparel and clothing in tonnes, which both increased by more than 20% in 2021 compared to 2020. A lot of these goods were exported to Europe and to the U.S.

Thanks to the COVID-19 Stimulus Package, which was passed in the U.S. Congress in March 2021, the consumption in the U.S. grew quite fast. A higher demand for textiles was visible not only in the import data of apparel and clothing (in tonnes), which reached a new peak in 2021, but also in a higher production of knitted fabrics within the U.S.

Globally the work from home trend continued, which maintained the demand for sportswear as compared to the decline in formal office wear, shirts and trousers.

As seen in the past year, Warp knitted fabric had become popular in sportswear, high-performance cycling shorts, football jerseys, footwear, etc. The warp knitting continued to perform much better in 2021.

In total dynamic recovery of knitted fabric production arrived at a new all-time-high.

Woven Fabric

Compared to knitting, the weaving industry suffered more in 2020 due to the reduced demand for formal and office wear during lockdowns and periods of working from home. While we reported last year that the total production of woven fabric declined by almost 30% in 2020, we now consider a smaller downturn in 2020 as more reasonable as we learned that inventory accumulation was more pronounced at the end of the textile chain than initially suggested. In 2021, the worldwide production of woven fabric increased by almost 20% but still not reached pre-Covid level. Just like in knitting, the recovery of the weaving market was also visible in the machine builder business. The number of weaving machines sold into the market in 2021 increased by around 30% compared to 2020.

In the biggest producing countries for weaving in Asia we have noticed a good recovery compared to 2020. Of course, increasing prices for raw material, high freight costs and local lockdowns impacted the weaving industry in the same way the knitting industry was affected. Without these negative effects, the increase in woven fabric production would have been even higher.

In China, the production of woven fabrics was quite good as reflected in the export data of the country. Woven home textiles and woven technical textiles have fully recovered and are back on the level of 2019. The production of woven apparel recovered but is still below the level of the pre-COVID year 2019. One reason might be that even though the lockdowns in many western countries ended, the possibility for working from home is still there and that means the lower demand for office wear might be a lasting effect of the coronavirus pandemic.

China is by far the biggest producer of woven fabric, but comparing the percentage growth, we see a similar situation in other Asian markets like India and Bangladesh.

In general, India had a good year when it comes to weaving. Except for the time of lockdowns in May, the orders for the domestic and export market were quite good. Within the export orders, technical textiles and home textiles were quite strong.

A similar image can be seen in Türkiye, where good orders for woven home textiles kept the weavers busy all through the year. Technical weavers producing tire cord for the automotive industry felt the effect of the computer chip shortage that hit the industry in 2021. The situation for woven apparel got a little bit better in the second half of the year and the export quantity of woven apparel and clothing reached a new peak in 2021. Also, the investment in new weaving machines reached a historic high.

Nonwovens

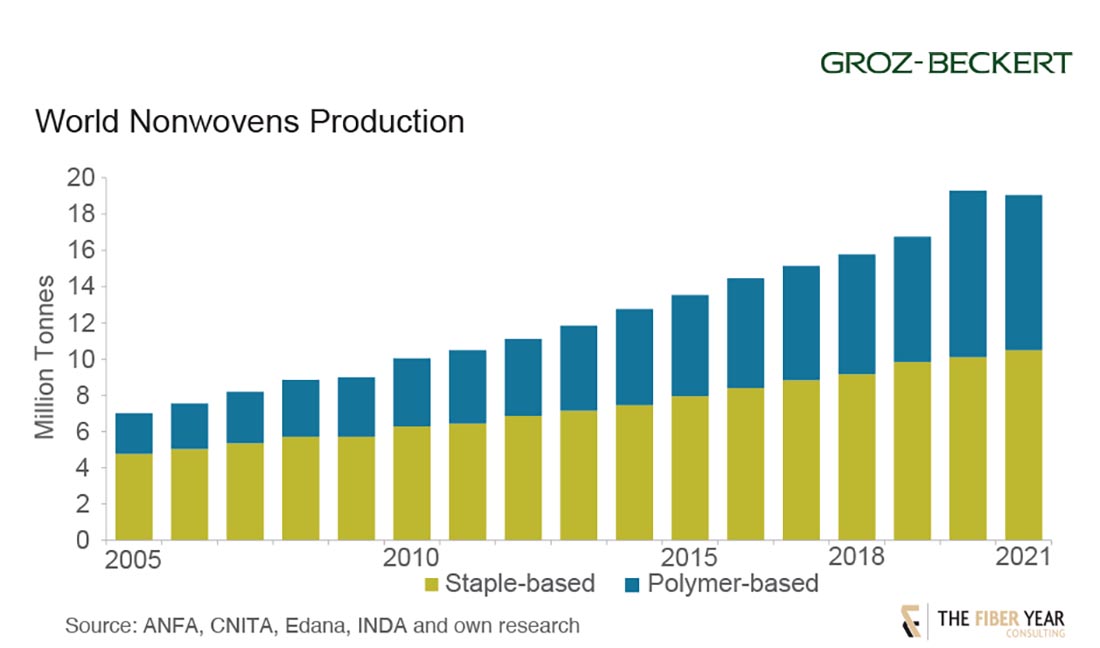

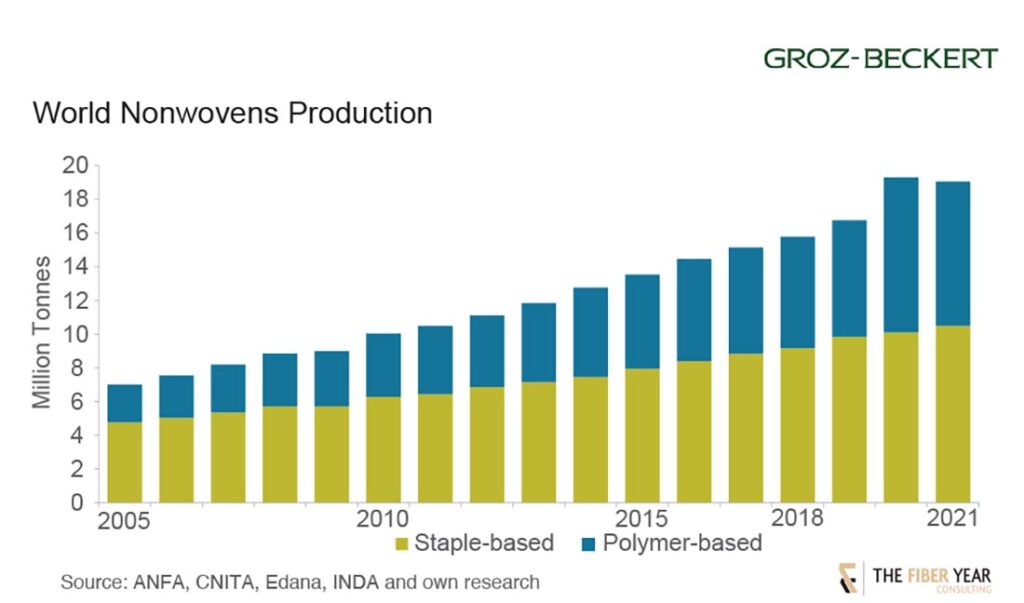

Global nonwovens manufacturing had to accept its very first annual decrease after outsized demand in the year before. Fiber-based nonwovens continued their steady growth in quota-free period, up by almost 4% to 10.5 million tonnes. Polymer-based types, experiencing unprecedented dynamics in 2020 by skyrocketing incredible 33%, weakened almost 7% to 8.5 million tonnes.

While joint supply softened 1%, the decisive difference to fibers was that nonwovens industry returned to its long-term growth dynamics we were used to prior to pandemic.

Asian manufacturing has confirmed its majority share despite contribution from the industry in mainland China shrinking almost 7% and losses in Korea and Taiwan, stagnation in Japan, gains in Indonesia, Malaysia and Thailand while Indian output surged 18% to an all-time high following dynamic spunlaid and needlepunched operations. The main processes in PR China experienced a mixed performance with spunlaids for anti-pandemic materials dropping while polyester spunlaids for engineering end-uses surged. Output of needlepunched nonwovens rose 6% and spunlaced nonwovens increased by 8%.

American production expanded 3% and by 2% in Europe with growth drivers in both regions resulting from dry- and spunlaid activities.

Outlook 2022

The outlook considerably darkened from 6.1% global growth last year to 3.2% in 2022 according to IMF World Economic Outlook Update in July, which was 1.2% lower than the forecast in January.

The war in Ukraine, higher-than-expected inflation worldwide – primarily in the U.S. and major European economies – geopolitical instabilities, ongoing supply disruptions and port congestions from China’s zero-COVID-policy, extreme developments in energy and feedstock markets have hit world economy that still is recovering from pandemic.

High inflation rates across most parts of the world are expected to remain throughout the year and in 2023. This will increasingly dampen consumer sentiment. Textile and apparel retail sales in the first six months improved over the preceding year. However, they did not reach pre-pandemic level. A further softening seems most likely which may lead to reduced operating rates and temporarily suspended production given high inventory holdings along the chain and apparently early inventory inflows of autumn/winter collections at brands and retailers.

The value of the imported knitted and woven apparel to the U.S. increased by 35% to 40% compared to 2021. Unfortunately, the expectation for the second half of 2022 looks less promising.

The forecast for this year’s fiber supply suggests natural fibers output climbing about 4%. Natural fiber expansion essentially will arise from cotton in 21/22 season.

Latest projections for the 22/23 season, starting in August, include drastic impacts from extreme weather events as currently noticed in Australia, India, Pakistan and Texas.

Wood-based cellulosics are projected to increase around 3% and synthetics expected to be flat. An unpredictable Q4, of course, might significantly mess up the prediction for manmade fibers.

The challenges mentioned of course affect both, the weaving and the knitting industry. For China, the biggest producer of knitted and woven apparel and textile, lockdowns were still the main tool to stop the spread of COVID. In 2022, we already saw several local lockdowns in China which of course also effected the producers of textiles in the respective areas. Even though a few orders were shifted from China to other markets, the export figures for the first half of China are looking quite good. Compared to the first half of 2021, we see an increase of knitted and woven apparel exports and also in textile. But given the unreliability in delivery time, new COVID lockdowns disrupting supply chain, China is expected to face reduction in orders in the remaining months of 2022. Additionally, the laws concerning Xinjiang related imports came into effect in mid of 2022, which will bring more uncertainties in the coming months, with the fabric and apparel producers being highly cautious. This can also be seen in the investments in new knitting machines. The Chinese machine builders of circular and flat knitting machines reported a sales quantity for the first half of 2022 which is about 30% below the sales quantity of the first half of 2021. For warp knitting machines the decrease in the sales quantity is even higher.

But besides China, the situation in other Asian countries looked quite promising in the first half of 2022. Focusing only on the apparel exports in the first half of 2022 almost all producers of knitted and woven apparel exceeded their exports in USD compared to the first half of the pre-COVID-year 2019. Bangladesh continued to stay on top of apparel exports: Knitted apparel exports went up by +30% while woven increased by +33%. Vietnam also exported a lot of apparel in the first half of 2022, but a downturn was visible already in August for both, knitting and weaving. This negative trend can also be seen in other Asian countries. In general, sales are expected to go down in the second half of 2022 due to reduction in orders.

In the first half of 2022 the value of the imported knitted and woven apparel to the U.S. increased by 35% to 40% compared to 2021. Unfortunately, the expectation for the second half of 2022 looks less promising. The effects of inflation are expected to grow further in the coming months, with consumers cutting down on apparel and footwear expenses. U.S. fashion companies are expected to turn more conservative about placing new sourcing orders in the second half of the year to control inventory and avoid stockpiling.

This negative outlook is also reflected in the Manufacturing PMI of the U.S. in August: The index has not been on such a low level since the coronavirus hit the U.S. in mid 2020. It’s interesting to see, that the respective purchasing manager indices of Europe and China are also on a very low level. Therefore, it can be expected that the worldwide demand will remain flat until the end of 2022.

The crisis-proof applications of disposable articles are expected to further expand at different pace by region spurred by demographics while lowering disposable incomes and downgraded economic growth rather cause decelerated growth. Governmental regulations during wintertime will certainly be a determining factor for demand of hygiene products.

Demand for durable products is anticipated to be rather flat. Growth in automotive applications despite further deficits in computer chips means an improvement from very low levels that are mostly far away from pre-pandemic build rates. For example, passenger car production in the U.S. during the first seven months rose 4%, still a third below 2019 output, and was up in China by almost 6%, which was near pre-crisis level.

The next installment of “The Fiber Year” column will pick staple fibers out as the central theme.