The Fiber Year in its 22nd edition compiled textile and clothing trade data for more than 60 countries with double-digit expansions in both export and import value. Asian industries lifted exports jointly by 13% apart from Myanmar with its economy severely impacted by the military coup in February 2021. Greater European area, including extra-EU data only, experienced a 3% decline in import value due to lower inflow of primarily face masks into EU and the UK. A specific view into the 27-nation European Union revealed deliveries in value terms dropping 4% while inter-regional trading surged by 18%.

The Americas recorded an enlarged trade deficit of US$115 billion with U.S. trade deficit widening to a record US$91 billion. The development in other major trading countries was outshone by virtually doubling exports from Australia following a spectacular surge in both cotton and wool shipments. This article has been further enhanced by latest trade developments in the first six months of 2022.

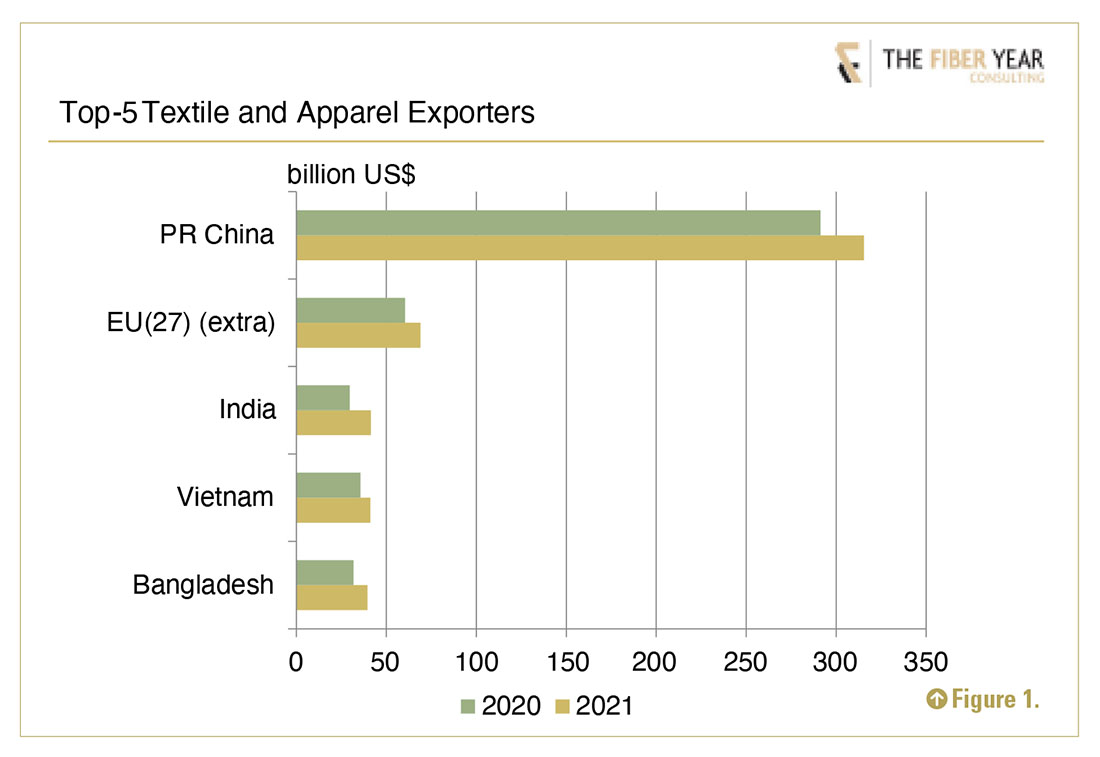

The top five exporters including extra-EU saw their joint value rising 13% to US$507 billion, essentially pushed by inflationary pressure that let us forget supply disruptions, several Corona-induced shutdowns of ports, port congestions causing delays in delivery and worker shortage in logistics.

Chinese exports achieved an all-time high at US$315 billion after increasing 8% with textile shipments falling 6% to US$145 billion due to lower face mask exports by value. Apparel export reversed its downward tendency, up 24% to US$170 billion to hit a six-year high, which still was US$16 billion below the peak in 2014.

The majority of US$69 billion extra-EU exports comprised apparel that succeeded to expand knitwear shipments by 10% and woven garment by 13%.

India marked an all-time high in export value at US$41 billion, up 40%, which was the fastest growth rate among top suppliers, primarily driven by cotton, both manmade fiber and garment chapters.

Exports from Vietnam rose 15% to US$41 billion and marked the second-highest trade surplus in history, although major markets experienced different dynamics with strong gains into U.S. and Korea, slow movement into EU despite EU-Vietnam Free Trade Agreement entering into force August 2020, decreases into Japan while the value into PR China rebounded 18%.

The textile chain in Bangladesh is of paramount importance as its share in national exports amounts to more than 85%. Last year’s exports jumped 25% to US$40 billion, generating US$27 record-high surplus.

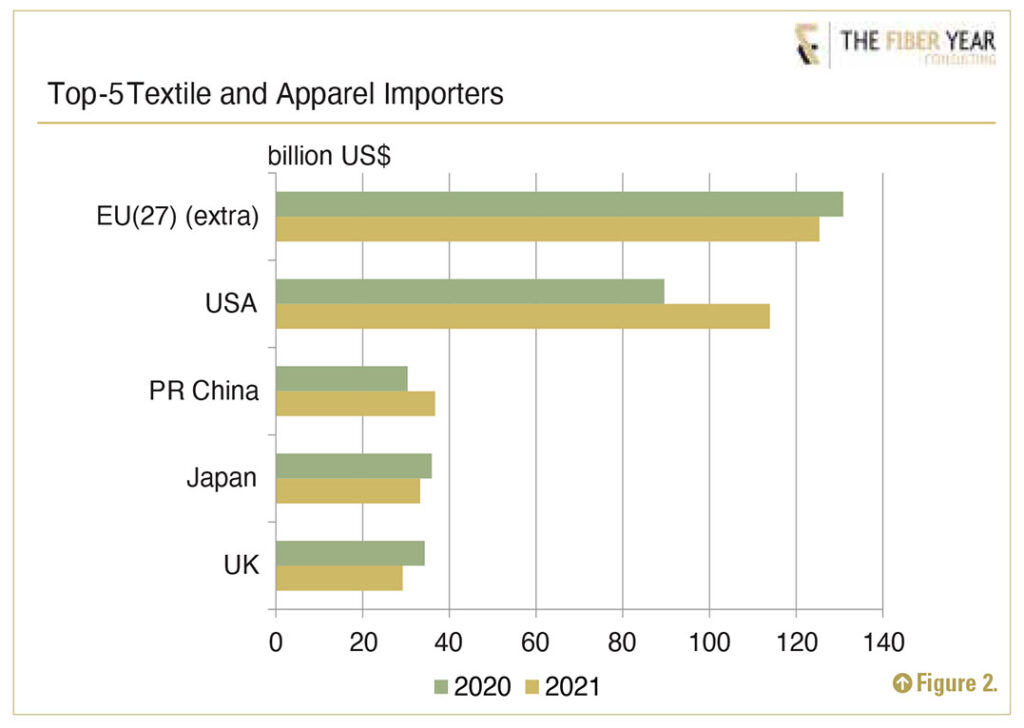

Import flows have shown a mixed performance with the top-five import destinations lifting their joint foreign sourcing by 5% to US$339 billion. However, last year has not seen a broadly based recovery in apparel demand when taking a look at volumes in comparison to the pre-pandemic year. The U.S. with adjusted apparel retail sales skyrocketing by 44% and apparel imports jumping 27% to US$82 billion expanded apparel imports in volume terms by 8% or 0.4 million tonnes, whereas cumulative volume shipped into EU, UK and Japan was short 0.8 million tonnes.

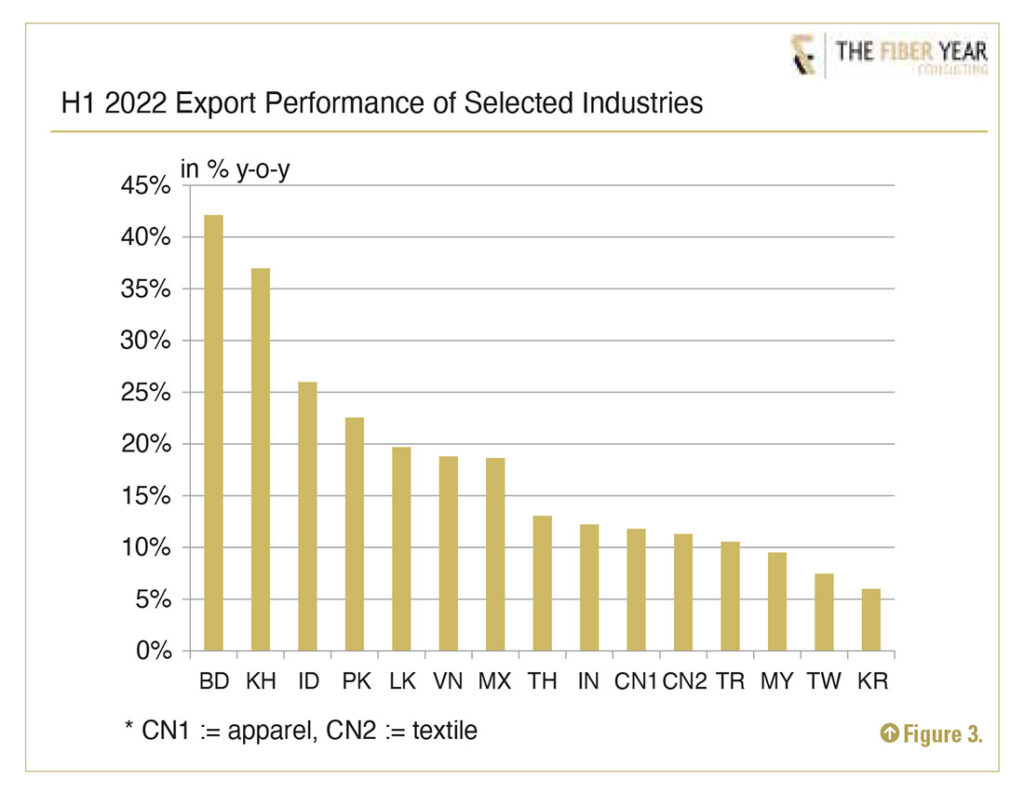

Mexico, the only non-Asian industry among the ten fastest growing textile and apparel exporters, benefited from strong U.S. demand.

Chinese imports surged 21% to US$37 billion including raw materials up 23% to US$9 billion, textiles up 14% to US$16 billion and apparel jumping 29% to US$12 billion.

The development of export values in selected industries during the first six months of 2022 was clearly pushed by a price surge in energy. Energy at such an elevated level was not even suspected in wildest expectations. Higher wages, increases in feedstocks, chemicals, additives and logistics further added to concerns.

It appears recommendable to put fast-moving prices into perspective with volumes to get a better sense of the sentiment in the manufacturing sector. Therefore, latest developments will be exemplarily analyzed on the basis of EU data. Imports in Euro terms jumped 36% from the shown suppliers while quantity increased 13% with just three industries (Indonesia, Sri Lanka and Thailand) suffering from reduced volumes at around 4% each.

Mexico, the only non-Asian industry among the ten fastest growing textile and apparel exporters, benefited from strong U.S. demand. However, U.S. retail sales came in flat in July with apparel sales declining 0.6% on a monthly basis and consumers seem to shift their spending to services. In addition, inventory adjustments will probably gain weight and may cause lowered flows into the market.

High inflation rates across most parts of the world are expected to remain throughout the year. Potential recession especially looms in Europe as energy prices soar. Moreover, the region could actually face energy rationing in wintertime. An accelerating price spiral might push the system on the verge of a collapse. Companies will no longer be able to cover costs, consequentially reducing operating rates, temporarily suspending production or further raising prices to run the risk of choking off demand.

The next installment of “The Fiber Year” column will summarize the presentation “The Fabric Year 2022” delivered together with Groz-Beckert KG in October.