Global supply of staple fibers and filament yarns recorded an average annual growth rate of 3% during the previous four decades. The dominant share of staple fibers, accounting for more than 80% in the 1980s, gradually scaled down. At present, staple fiber volumes still are one step ahead with a relative majority of 52% thanks to dynamic manmade cellulosic and synthetic fiber movements, while natural fibers slowly advanced. Development after the turn of the millennium clearly revealed a distinct tendency in favor of mainly wood-based types comprising viscose, modal and lyocell fibers.

The long-term development of staple fibers and filament yarns production experienced growth from 35 million tonnes in 1980 to 113 million tonnes currently. The group of staple fibers managed to double its output while supply of filaments multiplied its quantity ninefold. Hence, global position of staple fibers has steadily lost to filament yarns following slower growth rates. Nevertheless, the joint average annual growth rate amounted to 3%, which was more than double the yearly populations dynamics over this period.

Main end-uses for staple fibers are predominantly yarn manufacturing in secondary spinning with mostly blending different fiber types, fiber-based nonwovens and unspun applications for cigarette filters and filling or insulating materials.

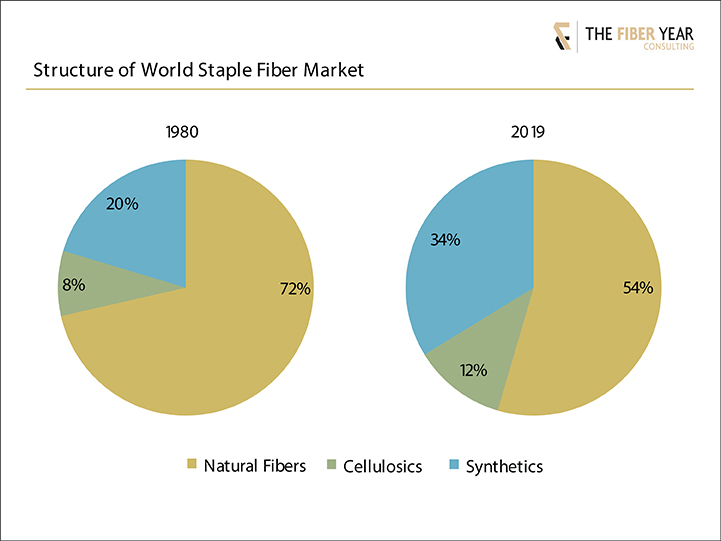

Composition of the global staple fiber market has considerably changed at the expense of natural fibers that saw their market share dropping to 54% by now, down from 72% in 1980.

The segment of natural fibers includes cotton, wool, bast and others with growth momentum purely originating from cotton, driven by the approval of genetically modified crops helping to raise yields from late 1990s. Hence, average cotton harvesting volumes gradually rose from 16 million tonnes in the 1980s to 25 million tonnes during the 2010s. Meanwhile, growth in wool suffered from continuous decreases after achieving its all-time high in 1990 at 2 million tonnes and accounting for almost half by now. The multitude of other natural fibers, ranging from large-scale jute to the tiny segment of agave fibers, was tolerably stagnant over time. However, pleasant from European perspective is to see growth in flax production from France and Belgium recently. Both countries contributed more than 85% to the global supply of around 325,000 tonnes in 2019.

Effective new volumes arose from the manmade fiber business with cellulosics adding about 4.5 million tonnes and synthetics, essentially polyester, contributing another 14 million tonnes. Other synthetic fibers delivered a mixed performance with polypropylene increasing volumes as well while manufacturing of acrylic and nylon fibers significantly diminished.

Dynamics in both decades of the last century were clearly in favor of synthetic fibers with average annual growth rates of almost 4%, whereas cellulosics suffered from long-term contraction after virtually little movement in the late 1960s and 1970s. Average value of natural fibers over the entire time span hovered between stagnation and 1.5% (at best), as it is always a question of climatic conditions and insect attacks that remains unpredictable.

Cellulosics started their breathtaking recovery after 2001 with average annual growth rates exceeding 6% since, which is equal to more than tripling manufacturing volumes, while dynamics of synthetic fibers continued to decelerate. In fact, the cellulosic staple fiber business has outperformed the entire market of synthetic staple fibers in every single year after the financial crisis. Furthermore, viscose staple fibers recorded nonstop growth in the eleventh year in a row, thus taking a unique position in the world staple fiber segment.

Market sentiment in favor of viscose staple fibers is even believed to accelerate when taking into account global investments in feedstock and fiber capacities, superior properties of this fiber type including its biodegradability, increasing media response to plastic waste from oil-based fibers, improved security of supply over natural fibers, growing awareness of consumers for environmentally safe clothing and sheer limitless raw material supply.

Natural fiber improvements were essentially driven by the approval of genetically modified cotton helping to improve yields from late 1990s.

The next installment of “The Fiber Year” column will throw a glance at the global development of spun and filament yarns. For more information on The Fiber Year Consulting and The Fiber Year annual industry report, visit thefiberyear.com.