The world economy started off on an optimistic note in 2018, following growth in manufacturing and trade the previous year. But optimism gave way to a downturn from midyear, as the International Monetary Fund revised down its 2018 projections for most advanced economies and predicted significantly lower growth expectations for 2019.

The economic climate took its toll on fiber production, which has experienced the slowest growth in three years at 1 percent to almost 106 million tonnes. Natural fibers softened nearly 2 percent as result of lower cotton cultivation while the manmade fiber business continued its 10-year expansion. Synthetic fibers grew by 2 percent, but were again outpaced by cellulosic fibers lifting output by almost 3 percent.

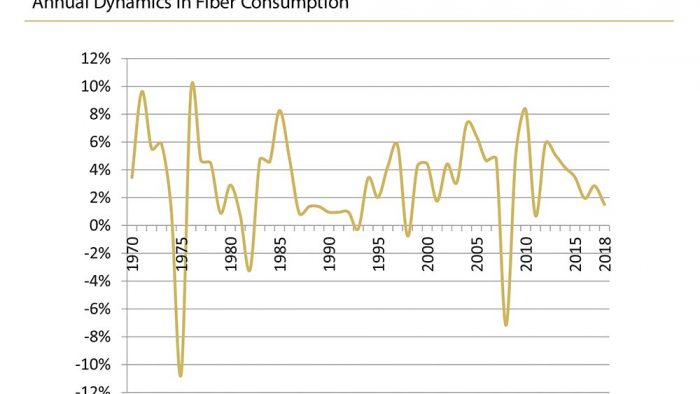

Overall, a downward tendency in terms of fiber market growth has been visible the last six years. While the expansion in 2012 marked an increase of nearly 6 percent, deceleration has been noticed since, and was down to 1.5 percent in 2018.

The yarn segment bucked the downward trend, with filament yarns recording the highest growth rate in three years and remaining in positive territory. Meanwhile, spun yarn manufacturing turned negative after a two-year growth period. Hence, filaments have not only maintained their majority share for the fifth year in a row, but strengthened their position to around 55 percent.

Nonwovens and unspun applications once again experienced a higher rate of expansion than fibers and yarns for the fifth consecutive year at 4 percent. However, last year’s increase in nonwovens and unspun applications marked the slowest growth in six years.

Overall, a downward tendency in terms of fiber market growth has been visible the last six years [Figure 1]. While the expansion in 2012 marked an increase of nearly 6 percent, deceleration has been noticed since, and was down to 1.5 percent in 2018. This length of annual decelerations in textile consumption is quite exceptional and unique in the 21st century.

The world fiber and filament market size of about 106 million tonnes corresponds to an average consumption per capita of 14 kg. The stimulating effect on fiber consumption from demographics continues to lessen. Developed countries, which tend to demand above-average volumes, are projected to see an annual population growth of just 0.2 percent until 2030, while less developed countries are forecast to have added 840 million new consumers by then, equal to a 1.1 percent average annual growth. Enlarged markets will derive from income gains and new fiber applications. The impact from fast fashion remains to be seen, as growing public awareness calls for sustainability along the entire apparel lifecycle.

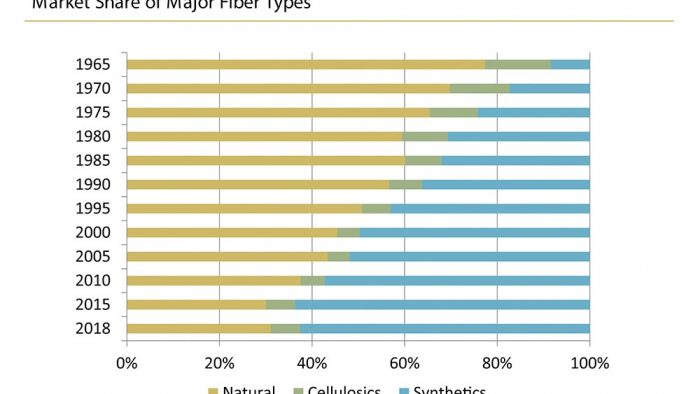

A look at fiber material composition reveals that manmade fibers make up about 70 percent of output, as the market has been steadily progressing in favor of manmade fibers, in particular polyester and viscose fibers, the only mainstream manmade staple fiber with consistent annual growth after the financial crisis of 2008. The perception of fibers being predominantly of manmade origin is well-known. What is new for probably the first time in history is that the share of synthetic fibers remained below its peak of 2015-2016 for the second consecutive year, while the relative position of cellulosic fibers arrived at the highest level in 27 years [Figure 2]. The long-term view of the global fiber market development shows drastic changes at expense of natural fibers, while manmade fibers tripled their share to nearly 70 percent.

Andreas Engelhardt will be authoring a regular column in International Fiber Journal highlighting trends in the global fiber marketplace. Material is based on the latest edition of Englehardt’s textile yearbook “The Fiber Year,” the latest edition of which was published at Techtextil, Frankfurt, in May. It covers manmade and natural fiber production around the world and includes nonwovens as well as data on unspun fibers. It reveals the latest developments and trade data for main markets and contains several contributions from industry experts ranging from biopolymers, cotton, viscose and wool to textile machinery shipments.

A table of contents of the yearbook is available at www.thefiberyear.com, detailing the broad coverage of markets and fiber sectors. Two different types of licenses have been introduced this year; a single-user license is a personal copy to the purchaser; and a company license allows sharing the yearbook with all colleagues within the company and its majority-owned subsidiaries.