Everyone now seems to have heard of meltblown, but what is meltblown? Meltblown is the term for one of the methods of forming resins/fibers into nonwoven material.

Meltblown is typically known for:

- Fine fibers – Meltblown is typically differentiated by its fiber size.

- Random fiber orientation

- High surface area – As a result of the fine fibers (1 to 3 microns in diameter), a meltblown web has six times more surface area and 36 times more fiber than a typical spunbond fabric of equivalent weight.

- Fibers of continuous length

- Focused applications – The fine fibers and high surface area of meltblown provides strong filtration and absorption/adsorption properties.

- Extremely versatile process – Meltblown is capable of producing material of widely different fiber diameter, material weight, thickness, and pore size, by means of a variety of polymer composition options.

The most commonly accepted definition for the meltblown process is:

A one-step process in which hot high-velocity air draws a molten thermoplastic resin extrude from a small orifice onto a conveyor or take-up screen to form a fine fibered self-bonded web.

A brief description would be:

The concept of attenuating molten polymer using high-velocity air.

The general process description is similar to the spunbond process, but in detail, the processes are quite different.

The meltblown process is similar to the spunbond process in that thermoplastic polymers are extruded through a spinning die to form filaments. The principle difference is that the meltblown process produces a web composed of finer filaments. Much of the difference is due to the way the air streams converge around the fiber as it exits the spinneret and accelerates the extrudate. The meltblown process uses large amounts of high-temperature air that is typically as high or higher than the temperature of the polymer. It requires a great deal of energy to heat the air on a continuous basis. Spunbond generally uses a smaller volume of air close to ambient temperature to apply the attenuation force.

Meltblown lines come in widths from 12 inches up to 5.5 meters. The most common size globally is 1.6 meters, while the most common sizes in Europe are 0.5 to 1.0 meters and in the United States, 2.6 and 3.2 meters. A single-beam 1.6-meter typical capacity is 550 to 600 tonnes per year, while a 3.2 meter three-beam configuration has production capacity reaching around 7,500 tonnes per year.

What it’s used for

Meltblown is used in a wide range of industries and applications. Due to the versatility of the meltblown process, many products can be developed and produced to the meet the requirements of specific applications.

Monolithic, or stand-alone, meltblown materials are found in more than a dozen principal end markets. Growth during the past two decades was driven by the rapid expansion of several markets, particularly filtration media, sorbents, and wipes.

At the present time, the following end-use segments make use of stand-alone meltblown:

- Filtration (air and liquid)

- Sorbents

- Insulation (acoustical and thermal)

- Other Applications

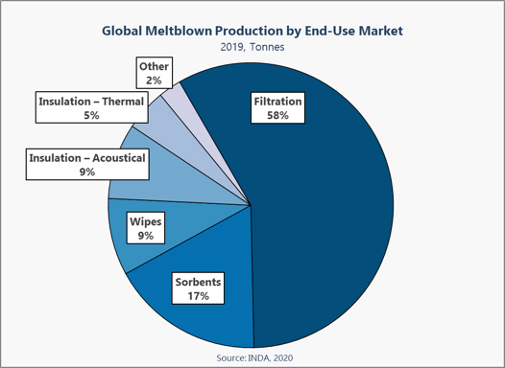

Globally, the predominate end use for meltblown is filtration media, with nearly two-thirds (58%) of the estimated global production in 2019 directed towards that end use. Filter media is followed by sorbents (17%) and wipes material (9%). Those three end-uses accounted for slightly more than three-quarters (84%) of the 2019 estimated meltblown production (Figure 1).

As a note, the above global meltblown production figure excludes Kimberly-Clark’s coform material and its heavier weight material with the inclusion of pulp in the material.

Where it’s produced

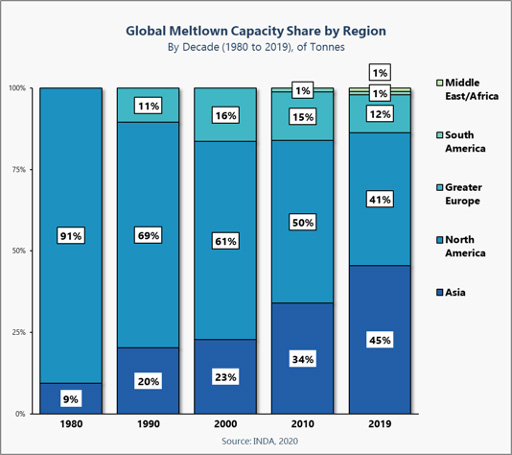

The United States, being the birthplace of meltblown, was the dominant producer globally from the 1970s through to the early 2010s. In recent years, the demand for meltblown nonwoven in Asia, primarily for filtration, was substantially higher as compared to other regions. The production of meltblown in Europe is relatively low.

Asia is now the largest producing region, having passed North America in the early 2010s, and now accounts for 45% of the capacity, with China (including Taiwan) accounting for 36% (Figure 2).

Unlike the meltblown consumed in composite structures, such as spunmelt and sold as rolls, much of meltblown produced globally is consumed internally by those companies producing the material. In North America it is estimated nearly 80% is consumed internally by those producing the meltblown.

What is the market outlook?

If not for the COVID-19 pandemic, the meltblown market would have maintained its low profile, being less than five percent of global production, and continued as is. However, the rapid onset of the pandemic led to significant shortages of personal protective equipment (PPE) throughout the world, notably in the United States and Europe and, in turn, exposed their heavy reliance on Chinese suppliers.

Facemasks have been in great demand throughout the world, and as meltblown is the heart of the facemask, a greater awareness and need has been placed upon the meltblown market. As a result, a number of individual regions and countries have made investments to ensure that they are never again totally reliant on imports of facemasks, whether from China or anywhere else.

This is not just a case study of only the impact of COVD-19 on meltblown respirator and medical facemask media, as this demand ripple will be felt across the entire meltblown market. The meltblown markets have briefly been derailed as facemask media—and other types of medical PPE—move from a “just-in-time” supply chain to “just-in-case.”

In the last few months, a significant amount of tonnage, a nearly 20% year-over-year increase, is being added to the global marketplace, including the introduction of stand-alone meltblown lines in Canada, Malaysia, Norway, the Philippines and Spain in 2020. It is estimated across the two-years (2020 and 2021) meltblown capacity will expand at an annual rate above 10%.

While a significant amount of meltblown is being added in 2020 and 2021, it will be consumed by a rising demand for meltblown across all the end uses and with additional meltblown capacity continuing to be added through the forecast period (2020–2025) to meet this rising demand.

For the purposes of this article and INDA’s report, only stand-alone meltblown is analyzed; the report does not include those that are combined with one or more other nonwovens to produce composite nonwovens such as spunmelt or spunbond-meltblown-spunbond (SMS).

As director of market intelligence and economic insights at INDA, Brad produces a number of market reports related to the nonwovens industry. His latest report, Meltblown Nonwovens Markets: COVID-19 Impact Analysis, was published at the beginning of August and updated in the middle of September (due to the fast changing landscape in the meltblown market amid the COVID-19 pandemic). More information on the report can be found at bit.ly/meltblownreport.

* International Fiber Journal is owned by INDA, Association of the Nonwoven Fabrics Industry (inda.org).